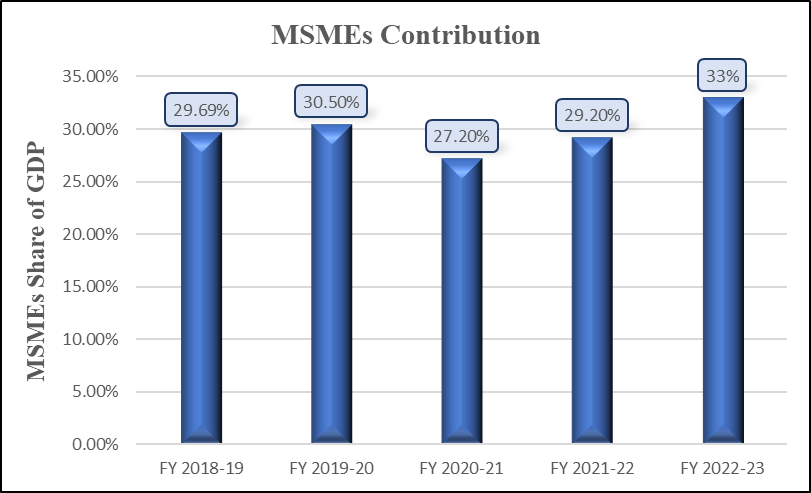

Indian economy is growing at a faster pace and the biggest contribution to the growth is of MSME sector. The MSME sector of India contributes to its 30% of GDP, 33% of manufacturing activities, and more than 40% of Exports. The sector is seen as an important source of employment, innovation, and growth for India, but still sector receives a disproportionate share of credit from the financial system of the country. A study conducted by the International Financial Corporation states that the gap between MSMEs credit lending in India is of whopping 16.66 lakh crore and more than 80% of MSMEs do not receive money from formal financing institutions.

In a country like India where financial institutions like Kingfisher, Adani, and Air India able to secure huge amounts of loans, why these small institutions are facing problems in accessing small amounts of loans. This indicates that there is a problem in the Indian banking system. Despite employing 10.73 crore people and contributing 30% GDP they are not able to access loans. To address this problem Mr. Nandan Nilekani (Co-Founder, Infosys) came up with a solution at Global Fintech Festival 2020 i.e. OCEN (Open Credit Enablement Network). It is seen as the next big thing after UPI and ONDC. The OCEN now in 2023 is now come alive to execution. The OCEN is built upon the foundation of Aadhar, UPI, GST, and the Indian banking system. The experts believe that OCEN will act as Brahmastra in bridging the credit gap in the MSME sector.

In a country like India situation for MSMEs is so bad because most MSMEs businesses purchase in cash but they have to sell their goods most of the time on credit. Also due to lack of collateral and credit history most of the time MSMEs don’t receive loans from banks and they have to opt for private lenders where they have to pay high interest for loans ranging from 3%-5% per week. The problem that banks face in financing the MSMEs is process for allocating loans to MSMEs is lengthy. Banks have to ask for documents after there is document verification and lastly if needed there is physical verification. The process becomes costly for banks and they have to spend nearly 5% amount of the loan on the process so they increase interest for MSMEs. The average interest rate for MSMEs ranges from 15% to 30%. The problems can be summarized as a lack of documents, risk analysis data and turnaround time and subsidy checking. Now how is OCEN rectifying the problem?

OCEN has three layers first one is of Identity layer where with the help of Aadhar and Digi locker identity of the business can be verified without submitting the physical documents. The second layer is of payments layer where banks can transfer the loans to MSMEs with the help of UPIs where loan repayments can also be done by using UPIs. The third and last layer is the Data layer in which data empowerment and protection architecture (DEPA) enables individuals and businesses to securely share their data with service providers. The seven lenders have already collaborated with OCEN to provide small-ticket loans. pilot projects for the network have been started where a loan of amount nearly 20 crores has been given to sizes from rupees 160 to rupees 10 lakhs. As per the World Bank report on OCEN, the digital platform making it easier and faster for MSMEs to get access to credit. The OCEN reduced the time for MSMEs to access credit from 25 days to 10 days, and it also increased the number of MSMEs to 20% that can get loans.

In conclusion, the initiative of OCEN a new digital infrastructure for small ticket lending in MSMEs is going to be Bramhastra. It will smoothen the process of accessing credit for MSMEs. It will help MSMEs to increase creditworthiness and also make them sustainable in bad business situations in times of low demand, which will eventually support the livelihood of 10 crore people, increase production, provide employment to more people and enable the sector to contribute a significant amount in the country’s GDP.