As the world becomes more conscious of the impacts of climate change, governments and businesses alike are turning to innovative financing solutions to help fund environmentally sustainable projects. One such solution is the issuance of green bonds, a type of debt instrument specifically designed to fund projects that have a positive impact on the environment. Similar to conventional bonds, green bonds are distinguished by the fact that projects that promote environmental sustainability are funded using the revenues from their issuing. These activities can range from energy efficiency improvements to sustainable agriculture and forestry, clean transportation, and infrastructure for renewable energy.

Governments, businesses, and other institutions that are dedicated to sustainable development frequently issue green bonds. With more businesses and governments realizing the value of sustainable finance, there has been an increase in the number of green bonds issued in recent years.

Why in News?

The government announced its intention to achieve a 45% reduction in GDP emission intensity from 2005 levels by 2030 in August 2022, with around 50% of the total installed capacity of electricity coming from sources other than fossil fuels. In light of this, it was announced that sovereign green bonds would be issued as part of the Union Budget for 2022–2023 to lure in international financiers to slow the pace of climate change.

Following these, the Reserve Bank of India (RBI) recently issued Rs 16,000 crore in sovereign green bonds (SGrBs).

What makes green bonds a crucial instrument for furthering sustainable development?

- The ability to collect money for initiatives that might not otherwise be commercially viable.

- Green bonds can aid in lowering greenhouse gas emissions, preserving biodiversity, and accelerating the shift to a low-carbon economy by directing investments into environmentally sound infrastructure.

- Green bonds can also inspire better responsibility and transparency about sustainable investment decisions. Investors may monitor the impact of their investment and make sure that their money is being utilized ethically.

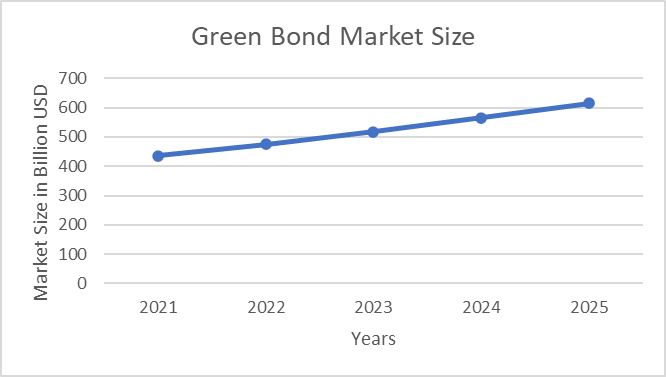

The global green bond has grown rapidly in recent years, with the issuance of over USD 436 bn in 2021, and is expected to reach USD 615 bn in 2025, a market forecast to rise at a CAGR of 9.0%. According to Climate Bonds Initiative, an international organization working to mobilize global capital for climate action, Indian entities have issued green bonds for over USD 18 bn. In January 2023, GSSS (Green, Social, Sustainability, and Sustainability-linked Debt) bonds accounted for USD 20 billion or 3.8 % of the country’s overall corporate bond market.

Benefits offered by Green Bonds to investors?

- It provides high profits with lower risk.

- Investors can be more satisfied that their money is being utilized ethically and sustainably because green bonds are linked to specific projects.

- Additionally, green bonds can give investors access to an expanding market for sustainable investments, which can aid in portfolio diversification and lower overall risk.

Conclusion

Green bonds are a crucial tool to advance sustainable development and combat climate change. Green bonds can aid in lowering greenhouse gas emissions, preserving biodiversity, and accelerating the shift to a low-carbon economy by directing investments toward environmentally sound initiatives.

The market for green bonds is anticipated to grow quickly as the need for sustainable finance around the world persists. This expansion will give investors a new chance to participate in ethical and sustainable ventures and promote the shift to a more sustainable future.