Indian agricultural market, a behemoth and critical component for nations economy with its size more than 370 billion facing a challenge, with disruption in red sea shipping areas and Govt of India’s decision of slashing the agriculture subsidies for second half of FY24 by more than 40 percent. This dual crisis possess a significant threat to the domestic agrochemical organisation, the crisis potentially may squeeze their margins by 15-20% and will also result in increasing the fertilizer prices by 7-10% for farmers. It will also impact the overall agricultural ecosystem by reducing the agricultural production impacting 1.3 billion people sustaining on agriculture.

The red sea route through Suez Canal is used by Indian industrial organisation and government for trade with nations of Europe, north America, north Africa, and some part of middle east. These regions contribute for 50% of India’s export 18 lakh crores and 30% imports which is of 17 lakh crores as per CIRSIL data. But due to recent crisis at red sea over 500 ships waited for 30 days in 2023, which exacerbating situations causing delays, surging freight cost and unpredicted deliveries. The impact of crisis will vary for different sectors, but organisations operating in sectors of Agri commodities and Agro chemicals will have more impact due to the perishable nature of their goods and low margin profile for products which restrict their abilities to absorb risk for rising freight cost. The Agri commodities like basmati rice are majorly shipped through this route. Marine foods are also being impacted due to small margins and perishable in nature. Exporters are trying to find some alternative routes for shipping of their produce, but the Panama Canal region is facing drought which is increasing their challenges for export through region.

Simultaneously the government’s decision to cut fertilizer subsidies by 1.25 trillion in the second half FY24 impacted 140 million farmers. Whereas due to red sea crisis fertilizer shipments are also facing delays which is affecting production planning. It is resulted in estimated ₹10,000 crore revenue loss for the Agro chemical industries which declined from 12% since last fiscal year. It is impacting more to the Agro chemical industries which are having ₹500 crore or more in fertilizer inventory, it’s been reduction of 15-20% in their profits. Due to situation some industries already went to price hikes and lowering discounts for dealer’s for safeguarding their margins. Whereas demand of fertilizer in key markets of Maharashtra and Karnataka has been hit due to rainfall deficit, with that international demand is also weak which is creating a disruption in domestic Agro industries market.

In addressing the double crisis occurred in front of Agro chemical industries, they must focus on achieving operational efficiency, supply chain diversification and major investments in research and development will play a crucial role. Governments intervention will also be a crucial factor, with targeted subsidy programs focusing small and marginal farmers, investment in domestic production capacities and improving logistic infrastructure could be a way forward. Collaborative efforts are being required to move out Agro chemical industry from double crisis which in term result in lowering the prices of Agro chemicals and boosting the agriculture production.

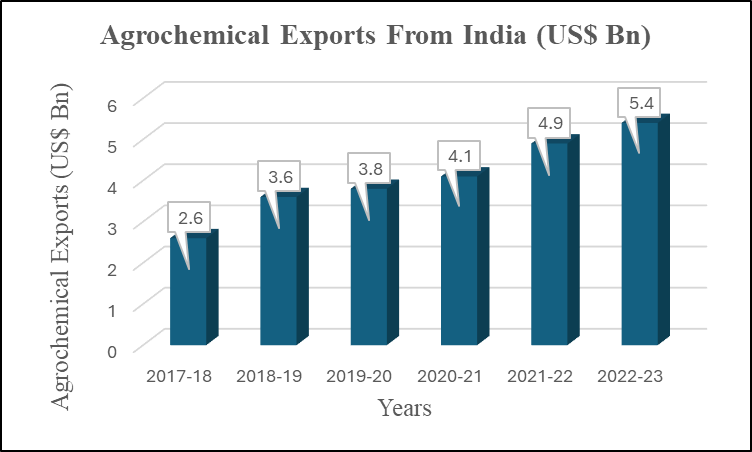

(Source: Ministry of Commerce)