On October 1 after several months of negotiation, a historic agreement came into effect Carbon Border Adjustment Mechanism i.e. CBAM. It is considered a landmark tool that will be used for putting fair prices on carbon emissions of carbon-intensive goods entering into the European Union. Its primary purpose is to stop the carbon leakage. CBAM is a policy tool introduced by the EU to reduce carbon emissions by imposing a carbon tax on imported products, ensuring that they are subject to the same carbon costs as products produced within the EU. It is part of the EU’s “Fit for 55 in 2030 package” to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels. CBAM aims to prevent carbon-intensive imports from undermining the EU’s climate objectives and to encourage the adoption of cleaner production practices around the world. The tax will range from 20-35% and will be levied on select imports starting January 1st, 2026.

Implementation:

To put the CBAM into effect, importers will have to submit an annual declaration detailing the number of commodities they import into the EU as well as their embedded greenhouse gas (GHG) emissions. The price of the CBAM certificates, which will be required to be surrendered by importers to offset these emissions, will be determined by the weekly average auction price of EU Emission Trading System (ETS) allowances in euros per tonne of CO2 emitted. The goal of CBAM is to make sure that carbon-intensive imports do not compromise its climate goals and will encourage cleaner manufacturing in the rest of the globe. By deterring businesses from moving to nations with laxer environmental laws, it can stop carbon leaks. The money received from CBAM will go toward advancing EU climate policy, which other nations can adopt to bolster green energy.

How might that affect India?

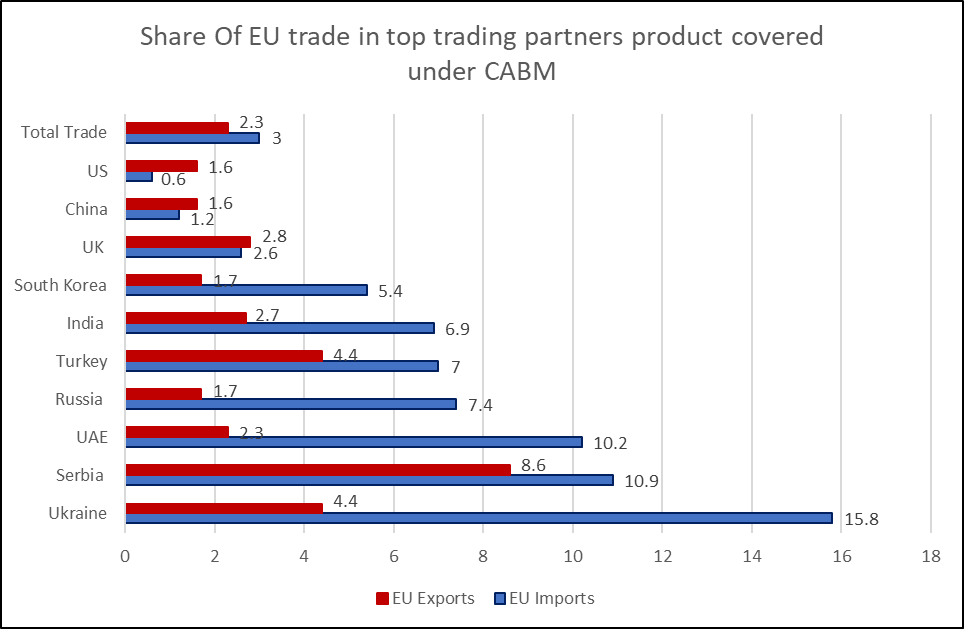

Exports will be affected because they will be subject to additional scrutiny under the process, India’s exports of metals, such as iron, steel, and aluminium goods, to the EU will suffer. Steel and iron ore, two of India’s top exports to the EU, are seriously threatened by carbon levies, which range from 19.8% to 52.7%. The EU will begin collecting carbon taxes on every shipment of steel, aluminium, cement, fertilizer, hydrogen, and energy on January 1st, 2026. Indian products have a substantially greater carbon intensity than those of the EU and many other nations because coal accounts for the majority of total energy use. India has about 75% of its electricity coming from coal, a percentage far higher than both the EU (15%) and the global average (36%). It will initially impact textiles, organic chemicals, pharmaceuticals, and refined petroleum products industries and may eventually spread to others.

India’s lack of a national carbon pricing plan increases the risk to its export competitiveness because other nations that have such systems may be required to pay less in carbon taxes or receive exemptions. To help make India’s production sector more carbon efficient, negotiations should be held with the EU about the transfer of clean technologies and funding structures. Furthermore, India ought to set up a Carbon Trading System in line with China and Russia to start preparing for the new system. India has the chance to take the lead in promoting environmentally friendly and sustainable production practices. This would help India maintain its competitiveness in a future where there will be a greater awareness of carbon emissions. India should use its leadership role in the G-20 in 2023 to persuade other nations to reject the EU’s carbon tax structure.

Conclusion:

The goal of the CBAM policy is to lower carbon emissions from imported goods while fostering fair trade practices. It may inspire other nations to enact more stringent environmental laws and lower global carbon emissions.

(Source: Peterson Institute of International Economics)