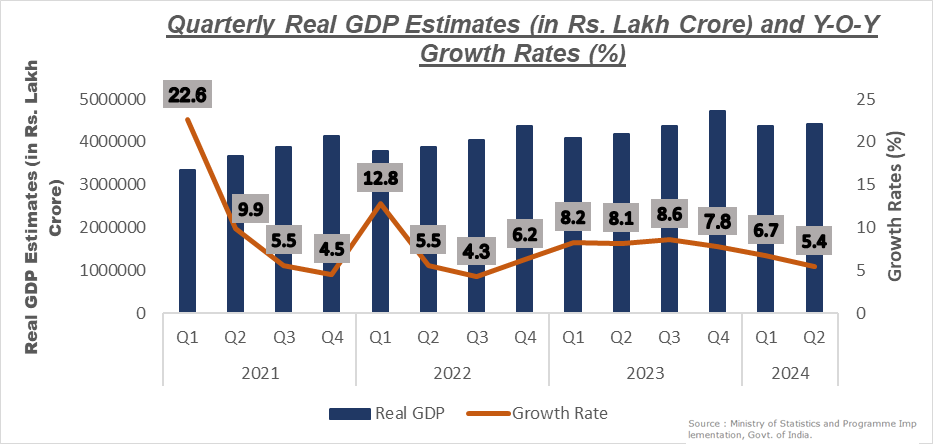

India’s economy faces slowing growth, with GDP at a 4-year low of 5.4%, and rising inflation, which recently surpassed 6%, exceeding the RBI’s target range of (2-6) %. In response, the government and RBI have implemented fiscal and monetary measures, including a repo rate cut and tax relief.

Source: Ministry of Statistics and Programme Implementation, Government of India.

India’s economic growth has been slowing due to both domestic and global factors. Key contributors to the slowdown include weak consumer demand, disrupted supply chains, and external pressures like rising energy prices and geopolitical tensions. The persistent inflation, particularly in food and fuel, has worsened the situation, eroding purchasing power and raising the cost of living for many citizens.

RBI’s Repo Rate Cut and Monetary Measures

To support economic activity, the RBI made a significant move in its February 2025 monetary policy review by announcing a 25 basis points cut in the repo rate, bringing it down from 6.5% to 6.25%. This cut is a critical step in reducing borrowing costs, with the hope of stimulating investment and consumption. The repo rate, the rate at which commercial banks borrow from the RBI, directly impacts the interest rates offered to businesses and individuals. Lower borrowing costs are expected to make it easier for businesses to expand and for consumers to take loans for houses, vehicles, and other needs.

This repo rate cut comes despite inflation remaining a concern. While the reduction in rates could provide a boost to growth, it also runs the risk of pushing demand higher, which could, in turn, increase inflation. The RBI’s decision to reduce the repo rate is, therefore, a delicate balancing act—encouraging economic activity without worsening inflationary pressures.

In addition to the repo rate cut, the RBI had also implemented a 50-basis points reduction in the Cash Reserve Ratio (CRR) in its December 2024 policy meeting, bringing it down from 4.5% to 4%. The CRR determines the proportion of banks’ deposits they must hold in reserve with the RBI. This move aimed to enhance liquidity in the banking system, making more funds available for lending. As a result of this CRR cut, banks were able to access an additional ₹1.16 trillion in liquidity, helping ease the liquidity crunch faced by businesses and consumers, thus supporting economic recovery.

Union Budget Measures: Tax Relief to Support Growth

In the 2025 Union Budget, the Indian government introduced significant tax relief aimed at spurring economic growth, particularly for middle-class households. The new tax regime offers lower rates, ranging from 5% to 30%, without exemptions or deductions, simplifying the tax process and increasing disposable income. This additional income is expected to boost consumer spending, which is vital for growth and demand stimulation. The government also aims to improve tax compliance, enhancing long-term revenue. The overall tax relief is estimated to benefit taxpayers by ₹1 trillion, supporting industrial recovery.

Global Economic Headwinds and Domestic Growth Outlook

Looking ahead, the global economic environment presents additional challenges for India’s recovery. Geopolitical tensions and tariff-related actions in international trade have led to volatility in financial markets, with the Indian rupee depreciating against the US dollar. This depreciation, while not as severe as other emerging market currencies, poses risks of higher import costs, which could contribute to inflation.

On the domestic front, India’s export sector is expected to face a muted outlook due to global uncertainties, particularly in the goods segment. As a result, India’s GDP growth is expected to remain below the 8% mark observed in the previous fiscal year, with growth estimates hovering around (6.5-7) % in the medium term. The bulk of the growth is expected to come from domestic consumption, which will be supported by the fiscal and monetary measures.

Despite the challenges, the government’s fiscal policy remains focused on boosting consumption and investment. With the fiscal deficit expected to narrow in the coming year, there is room for more targeted fiscal measures to support the economy. However, government spending, particularly in infrastructure and capex, will need to be calibrated to avoid intensifying fiscal constraints.

Conclusion: Navigating Uncertainty

India’s current economic situation presents a difficult challenge: stimulating growth while managing inflation. The recent repo rate cut, CRR reduction, and tax relief measures aim to boost the economy, but these actions could also drive-up inflation, particularly if demand increases faster than supply can adjust. Higher consumer spending resulting from tax cuts could fuel price increases, especially in essential goods like food and fuel, where inflation has been persistent. The success of these measures hinges on effectively controlling inflation in the coming months.

With global uncertainties adding complexity, India’s recovery depends on how well these policies are implemented and adjusted to evolving conditions. The focus will remain on achieving sustainable growth without exacerbating inflation, and while the fiscal and monetary measures provide hope, only time will reveal their long-term impact.

Sources:

- https://www.rbi.org.in/

- Moneycontrol

- PIB