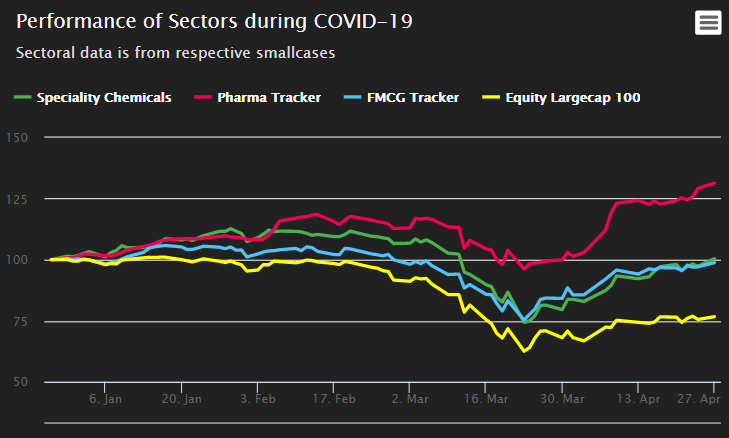

In this pandemic every sector facing its own problems and advantages. COVID-19 left no one it affected everyone may be with a greater impact or with a lesser one.

It might be a mouthful but here’s a look at what’s to come in the immediate future. Liquidity is expected to remain tight as the cost of borrowing in real terms will jump upwards. This is despite central banks’ efforts to reduce interest rates. Banks and financial institutions will be under immense pressure as the fear of NPAs, insolvency and bankruptcies increase multifold. The government will focus on meeting hyper demand for essential goods while non-essential businesses will focus on recovering their receivables/outstanding money due from debtors. New strategic alliances or business partnerships will not emerge during this period

If these were lyrics to a song, the specific genre would be doom metal.

I don’t want to sound like a pessimist – the road forward looks rough. While there are sectors and businesses that will benefit, the prognosis is rather grim. In my best guess, here are some of the sectors that will be adversely affected and others that will see an uptick.

Adversely affected Sectors

- Apparel & Textile will get hit adversely due to disruption in labor supply, raw material unavailability, working capital constraints and restricted demand due to limited movement of people and purchasing ability.

- Auto sector (which includes automobiles and auto parts) will continue to face challenges on account of lack of demand, global recession and falling income levels.

- Aviation & Tourism is one sector which has the highest probability of going under without direct government intervention. In the next 12 months, it’s highly unlikely people will travel for leisure apart from very essential travel.

- Shipping and Non-Food Retail – Nonfood retail chains and global shipping businesses will find this 12-month period very challenging.

- Building & Construction businesses are generally leveraged and hence will face the dual challenges of high-interest payments and lack of sales.

Comparing Debt to Equity Ratio of Sectors

| Sector | D/E Ratio |

| Real Estate | 0.86 |

| Information Technology | 0.11 |

| Consumer Staples (FMCG Food) | 0.49 |

| Financials (Investment Banking and Brokerage) | 0.083 |

Broadly, anything which involves personal interaction will face problems in the next 12 months – real estate or big-ticket items/luxury products.

Sectors with a possible uptick

- Digital & Internet Economy: Online based products & services companies will find new takers

- Ed-tech and Online Education along with firms involved with online-skill development

- Online groceries

- There will be a sudden spike in the demand for Content, with digital content being in demand more than ever.

- FMCG & Retail will benefit immensely. With continued fear, food-based retail chains, and companies catering to low-ticket consumption demand will emerge as winners.

- Specialty Chemicals: Firms dealing in Chemicals will see a jump due to increased demand for disinfectants, drugs and medicines.

- Pharma: Pharmaceutical firms are set to see growth in the near term