Introduction:

As India enters the crucial Rabi sowing season for 2024-25, farmers across the country are facing significant disruptions in the supply of di-ammonium phosphate (DAP), a key fertilizer for crops like wheat and mustard. This shortage is exacerbated by a combination of rising global fertilizer prices, logistical challenges, and an ongoing decline in imports, all of which have made DAP increasingly unaffordable and difficult to procure. The government’s response, including substantial subsidies, has not been enough to offset the economic pressures on fertilizer companies, leading to concerns over availability just as the sowing season is about to begin.

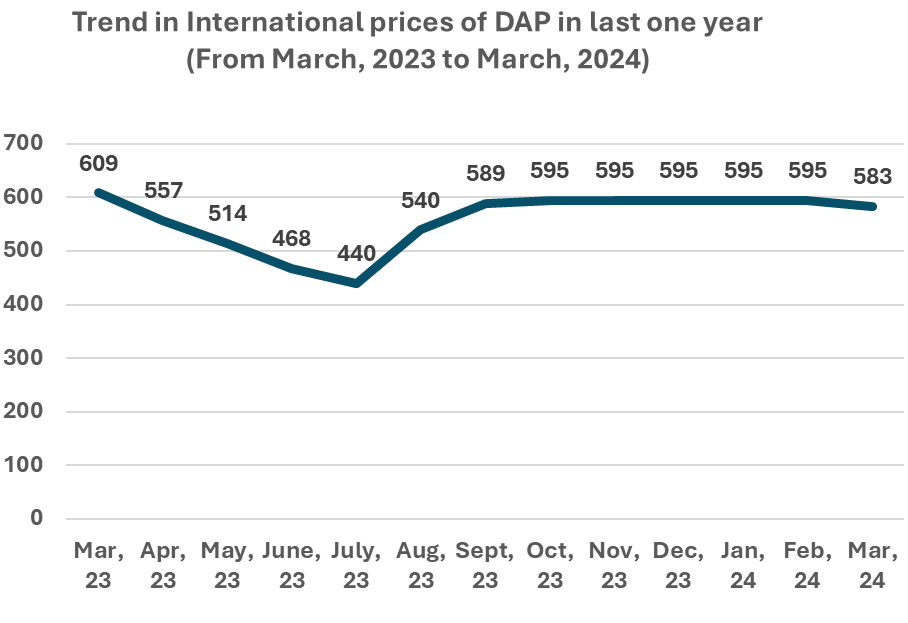

Rising Costs and Global Supply Disruptions:

The global fertilizer market has seen sharp increases in the price of DAP due to a series of disruptions. Supply issues in the Red Sea region, which handles a significant portion of global fertilizer shipments, have added strain to an already stretched supply chain. The disruption, largely caused by geopolitical tensions and shipping rerouting, has raised the landed cost of DAP in India by 26% — from $510 per tonne in May 2024 to $645 per tonne, or around Rs 54,000 per tonne in the domestic market.

While the Indian government has responded with subsidies, including an increase in the fertilizer subsidy package for the rabi season (up 10% year-on-year to Rs 24,474 crore), the steep rise in the global price of DAP has made the fertilizer increasingly uneconomical for manufacturers and suppliers. Despite a maximum retail price (MRP) cap of Rs 27,000 per tonne, the subsidy and price control mechanism have not been enough to cushion the blow to the industry.

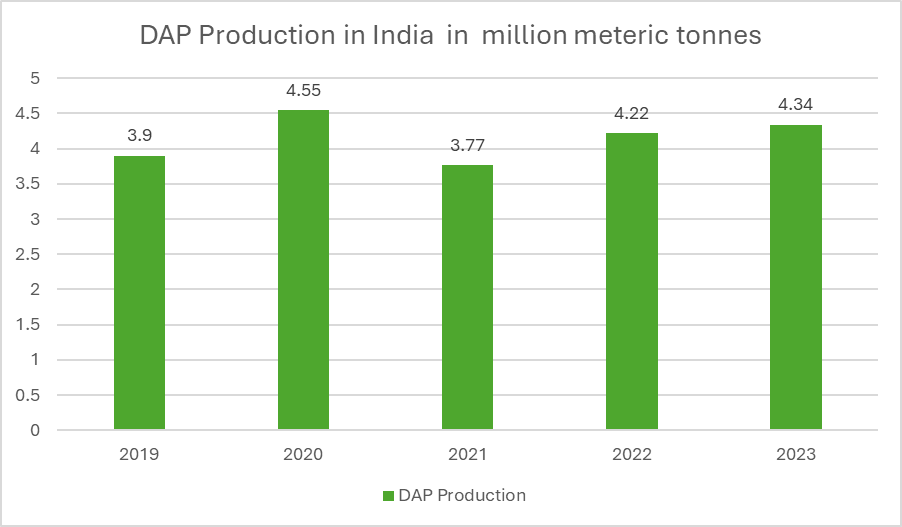

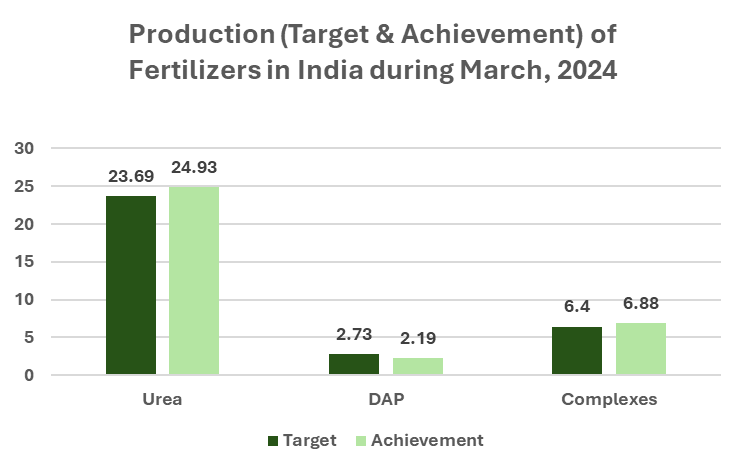

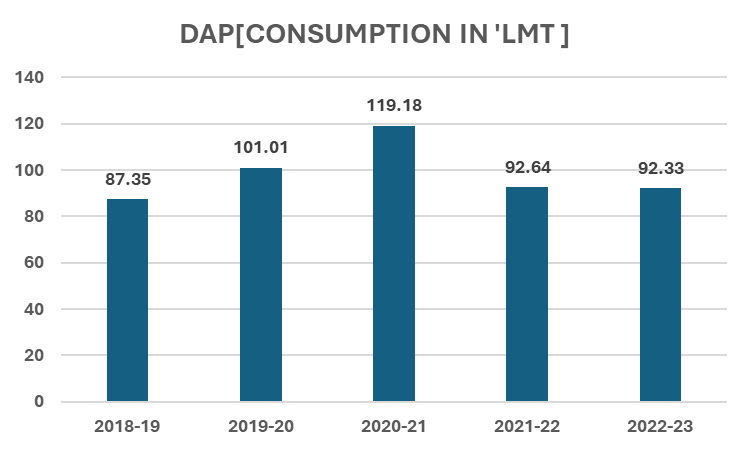

Decline in Imports and Domestic Production:

The effects of the price surge are visible in the country’s import and production statistics. Fertilizer imports during the first half of the current fiscal year (April–September 2024) have dropped by 43%, falling to 1.96 million tonnes (MT) from 3.45 MT during the same period in 2023-24. Domestic production has also seen a decline of 7%, with output falling to 2.15 MT in the first half of 2024 compared to previous years.

As a result, India’s inventory of DAP has been significantly reduced. Carry-forward stocks at the beginning of the season stood at around 1.6 MT, down from 3 MT in 2023, exacerbating the fertilizer crisis. This reduced stockpile, coupled with delays in imports, has left many states facing severe shortages, particularly in regions like Haryana, Punjab, and Uttar Pradesh — all critical areas for Rabi crop sowing.

Logistical Challenges and the Impact on Supply:

The logistical issues surrounding DAP imports have further compounded the supply problem. Due to the rerouting of shipping vessels through longer routes, such as the Cape of Good Hope around the southern tip of Africa, shipments are taking an additional 14 to 45 days to reach Indian ports like Kandla. This delay in the arrival of imported DAP has created a supply gap, especially just ahead of the sowing season, which typically begins in November.

As per government assessments, approximately 60% of the DAP required for the rabi season will be imported, with the balance being met by domestic production. The total demand for DAP in the rabi season is projected to be around 5.5 million tons, but with reduced imports and domestic production falling short, the situation has become increasingly precarious.

Government Measures and Subsidy Adjustments:

In response to the rising costs, the Indian government has introduced several subsidy measures aimed at making DAP more affordable for farmers. In addition to the Rs 24,474 crore subsidy announced in September for the rabi season, the Ministry of Fertilizers has also offered an additional subsidy of Rs 3,500 per tonne to ease the pressure on fertilizer companies and ensure continued procurement.

However, these subsidies have not been sufficient to offset the massive price increase. Fertilizer companies are under increasing financial strain due to the mismatch between the retail price caps and the actual cost of importing and distributing DAP. This financial pressure has resulted in lower procurement levels and reduced inventory availability, further deepening the fertilizer shortage.

Impact on Farmers and Agricultural Productivity:

The shortage of DAP is especially concerning for farmers preparing for the Rabi sowing season, as it is critical for the early-stage growth of crops like wheat and mustard. Without adequate supplies of this essential fertilizer, farmers may struggle to achieve optimal yields, affecting not just their income but also national food security.

Reports indicate that farmers in several regions have been forced to wait in long queues at fertilizer distribution centers, with some even traveling to neighboring districts in search of supplies. In some areas, fertilizer is being distributed under tight security, reflecting the tense situation and the urgency of ensuring timely availability.

If the supply gap persists, the overall productivity of Rabi crops may be compromised, leading to potential long-term repercussions for both local and national agricultural output.

Conclusion:

India’s ongoing DAP crisis underscores the fragility of its fertilizer supply chain amid global disruptions and rising costs. Despite government efforts like increased subsidies and import management, logistical delays and economic pressures have left DAP availability uncertain ahead of the 2024-25 Rabi season. A stronger partnership between the government and fertilizer companies is crucial to ensure timely access to fertilizers, safeguarding agricultural productivity and national food security.

Source and references

https://www.indiastat.com/data/agriculture/consumption-of-fertiliser-nurtients

https://www.statista.com/statistics/1120106/india-dap-production-volume/